- May 09, 2023

- By Carrie Handwerker

With climate change making extreme weather events more frequent and intense, Maryland homeowners are increasingly faced with the threat of costly home damage—from flooded ground floors to unwanted skylights from windblown fallen trees.

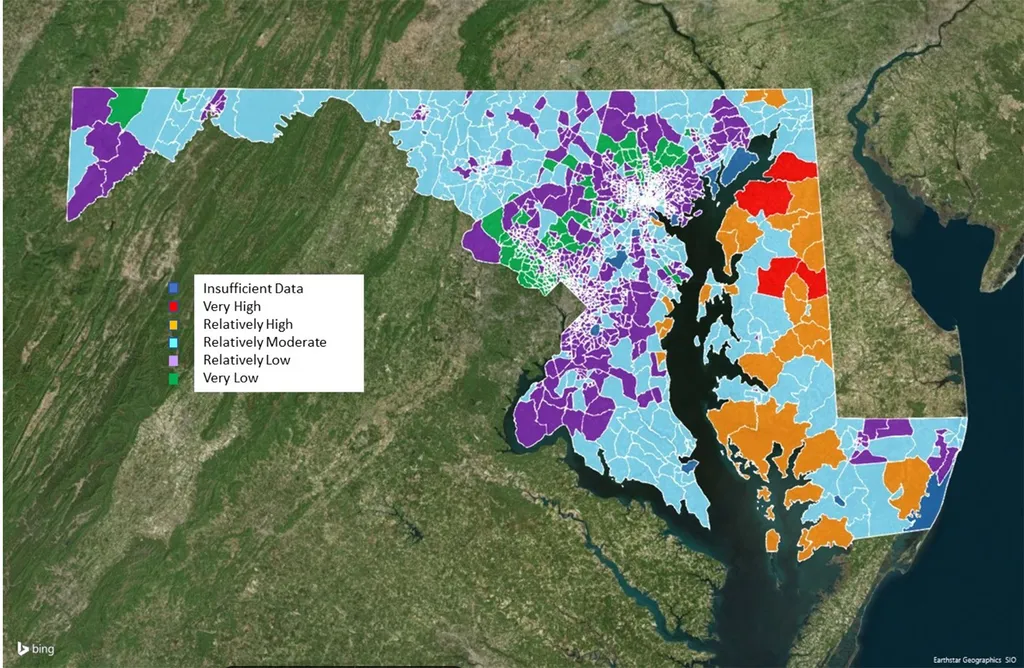

To help property owners and other stakeholders plan for those rainy (or drought-stricken) days, University of Maryland finance Professor of the Practice Clifford Rossi developed the Homeowner Financial Vulnerability Index (HFVI), which categorizes the risk of weather-related damage for Maryland homeowners. The index (download a PDF) identifies regions in the state where residents are most likely to feel financial strain from getting hit with an unexpectedly large out-of-pocket expense.

Rossi, a risk management industry veteran, said identifying these pockets of vulnerability is critical for tailoring targeted financial products and services to help homeowners, and for policymakers and government agencies to determine where public investments in weather resiliency projects are most needed.

The index incorporates Home Mortgage Disclosure Act data for every loan originated in Maryland for 2021, plus loan-level credit performance data from government-sponsored enterprises Fannie Mae and Freddie Mac.

The study also uses data from the Federal Emergency Management Agency (FEMA) National Risk Index. FEMA’s calculations are composed of three factors: expected annual losses from 18 types of natural hazards at the county or U.S. Census tract level; a measure of a community’s ability to deal with a natural hazard, based on factors like capital and infrastructure; and a social vulnerability score, taking into account poverty, vehicles access, household crowding and other metrics.

In Maryland, the most threatening hazards are drought, tornadoes and coastal flooding, but Rossi found that the vast majority of tracts in the state have relatively moderate or low risk.

According to Rossi’s index, only four areas in Maryland have very high combined hazard risk and financial vulnerability, while 30 more than tracts fall into the next-highest risk category. Areas with the most risk are clustered on Maryland’s Eastern Shore, with some others on the western shore of the Chesapeake Bay.

“These areas are some of the least densely populated areas in the state, where agriculture and fishing are major industries,” Rossi wrote in the new study. They also have low minority populations relative to more populous areas of Maryland.

The index can help target federal, state and local funding for shoreline protection or flood control measures in places they’ll help the most, and give insurers and mortgage providers information to come up with innovative products for individual homeowners in high-risk areas.

“Current and prospective homeowners living in high hazard risk areas will need new products and services to help them understand and manage the physical and financial risks they face from extreme weather events now and in the future,” Rossi said. “For new homeowners, having tools that help identify the physical risks of their area is critical before making a purchase.”

Current homeowners can also benefit from guidance in the index about taking advantage of forward-looking tools that can provide them with perspectives on hazards happening not just this year, but in future decades.

For instance, adjustable balance mortgages can incentivize proactive investments in projects to shore up homes to make them more resilient to weather extremes, Rossi said. Other financial products could also be developed to provide relief to homeowners facing post-disaster renovations and repairs not covered by insurance, Rossi said.

Topics

Research